Michigan Democrats’ Working Families Tax Credit taking effect on Feb. 13 quintuples state EITC, stands to help save 700,000 Michiganders around $3,150 a year

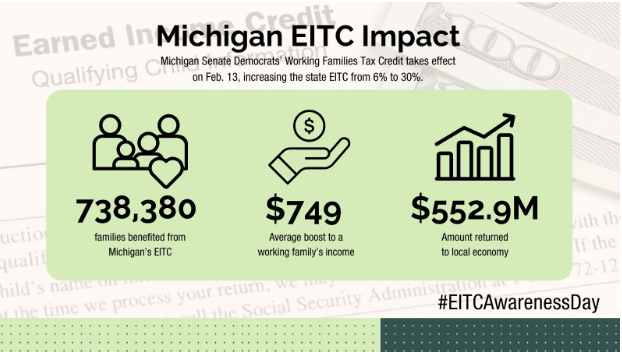

On EITC Awareness Day today, Michigan Senate Democrats are celebrating their passage of the most significant increase to the credit in state history. To help alleviate financial hardship for families, Senate Democrats created the Working Families Tax Credit — quintupling Michigan’s match of the federal Earned Income Tax Credit (EITC) from 6% to 30%.

The Working Families Tax Credit was part of the Lowering MI Costs Plan — the biggest tax relief initiative Michigan has seen in decades — that Senate Democrats finalized last March. The plan also overhauled the unfair and unpopular retirement tax. The proposal was designed to combat rising costs, high fuel prices and supply chain issues and help more Michigan families and seniors save money.

Senate Majority Leader Winnie Brinks (D-Grand Rapids) joins Senate Democrats and Gov. Gretchen Whitmer to announce the Lowering MI Costs plan to help provide historic tax relief to seniors and working families across Michigan.

“From the very beginning of our Majority for the People, we have been dedicated to making it easier to raise a family, promoting safe and thriving neighborhoods, and helping folks earn a decent paycheck while keeping more of it in their pocket at the end of the month,” said Senate Majority Leader Winnie Brinks (D-Grand Rapids).

Scheduled to take effect on February 13, 2024 — this expansion will help 700,000 Michiganders who have the hardest time affording the basics save an average of $3,150 per year.

In addition to claiming it this tax season, the expanded Michigan EITC is also retroactive to the 2022 tax year. Federally eligible individuals who claimed the Michigan EITC on their 2022 taxes and received the original 6% credit can expect to receive a check with the remaining 24% portion of the credit.

“These dollars are a tremendous help to workers who are on the tightest of budgets. When families have financial stability, it improves so many other parts of their lives,” said Sen. McDonald Rivet, long-time champion and lead sponsor of the EITC increase. “We made this tax relief retroactive to tax year 2022, so households who qualified last year will automatically receive checks for the increased difference. That will help with awareness, and we’re going to put as much energy into helping eligible families claim this credit for tax year 2023 as we did expanding the state’s match to 30 percent.”

Sen. Kristen McDonald Rivet (D-Bay City) joins Gov. Whitmer, local leaders and first responders at a fire station in Saginaw to discuss the implementation of the expanded Earned Income Tax Credit and the rollback of Michigan’s retirement tax.

“We celebrate EITC Awareness Day every year, but today it’s a particularly big celebration because of last year’s boost to the state credit,” said Monique Stanton, President and CEO of the Michigan League for Public Policy. “Thanks to years of collaborative efforts and legislative champions like Sen. Kristen McDonald Rivet and Sen. Jeff Irwin, over half a million Michiganders with low incomes will see an average of $750 back in their pockets this year to pay for essentials. But we need to raise awareness about the credit for it to have greatest impact, so we’re encouraging folks to spread the word in their communities. The power of the EITC is strong, and so is the coalition of advocates, organizations and lawmakers who are continuing to build on that power to make the credit expanded even further in the future.”

It is estimated that the Working Families Tax Credit will contribute around $553 million to local economies and small businesses, as the EITC is often spent on necessities like childcare, car repairs, new appliances, groceries and more. Increasing the state EITC is a two-generation policy that helps kids by helping their parents, and it has been proven to have myriad positive benefits on kids.

“The Earned Income Tax Credit is a proven tool for lifting working families out of poverty, and the money generated for families goes right back into our local economies. When hardworking Michiganders get tax relief, they spend it on childcare, car repairs and other everyday expenses,” said Sen. Jeff Irwin (D-Ann Arbor), who sponsored legislation to increase the Michigan EITC last session and has advocated for this tax relief throughout his time in the Michigan Legislature.

“I encourage all eligible Michiganders to take advantage of the Michigan EITC this year. From awareness to expansion, we’re continuing the fight to make sure the EITC can make a difference for even more Michigan workers and families,” said Sen. Sam Singh (D-East Lansing). “With the Democrats’ boost to the credit taking effect next month, this credit will not only offer hardworking families an even greater and much-needed financial lift this tax season, but also play a crucial role in bolstering local economies. These savings will directly fuel investments in the small businesses that are the backbone of our local communities.”

ADDITIONAL INFORMATION:

Eligibility:

To be eligible for the credit, Michiganders must have worked and earned income under $63, 398 and have an investment income below $11,000, among other criteria. Currently, one in five eligible households do not claim the EITC. To find out if you qualify for this relief, visit IRS.gov/EITC.

Free Tax Help:

If Michigan residents meet EITC income requirements, they can qualify for free tax help. Residents can call 1-800-906-9887 or visit IRS.gov/vita to find IRS-trained volunteers for free tax return preparation. Eligible Michigan residents across the state can also call 2-1-1 on any phone or visit MichiganFreeTaxHelp.org to connect with a free tax preparation expert who can help them claim all the tax credits available, at no cost, ever.

Widespread Support:

Last year, nearly 230 organizations signed a letter urging Michigan leaders to adopt a 30% match of the federal EITC, citing it as a “pro-work” policy with immediate impact to boost local purchasing power. This included: business groups like the Michigan Chamber of Commerce and various local chambers of commerce, the Small Business Association, Business Leaders for Michigan; the Michigan League for Public Policy and other advocacy groups; the Michigan Association of United Ways, local United Ways around the state and other human services organizations; and more.

Bipartisan History:

Bipartisan since its inception, the federal EITC was created by Republican former President Gerald R. Ford and a Democratic Congress. The Michigan EITC was established by a Republican-led Legislature in 2006 and signed into law by then-Gov. Jennifer Granholm, a Democrat. Over the years, the EITC has been touted by Republicans and Democrats alike, including former President Ronald Reagan, Republican former U.S. House Speaker Paul Ryan, and Democratic former presidents Jimmy Carter and Barack Obama.