February 18, 2021

Hello Neighbors,

Things are starting to ramp up as a new legislative session is quickly underway. We’ve been hard at work introducing and co-sponsoring legislation that is important to you and our district.

In this issue, I’ve included important information regarding our upcoming virtual COVID-19 Vaccine Town Hall, with special guests from the Kent County Health Department and Mercy Health Saint Mary’s. I’ve also included a brief legislative update on some of the issues I’ve been working on.

Warm regards,

As always, please continue to look out for your friends and neighbors and be patient with one another. For the latest updates, I’d encourage you to follow me on Facebook and Twitter.

Winnie Brinks

State Senator

29th District

In This Issue

- Upcoming COVID-19 Vaccine Town Hall

- Legislative Update

- MDNR: Braving Winter to Enjoy Michigan’s Outdoors

- Income Tax Season Starts this Week

- Upcoming Virtual Coffee Hour

- Contact Us

UPCOMING COVID-19 VACCINE TOWN HALL

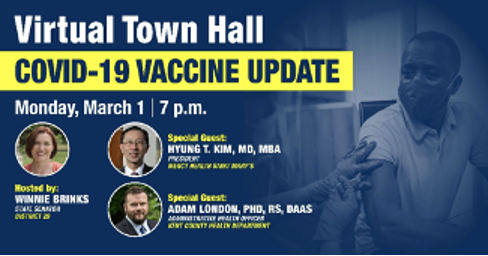

Please join me on Monday, March 1, at 7 p.m. for an event, Virtual Town Hall: Update on Covid-19. Panelists Dr. Adam London of the Kent County Health Department and Dr. Hyung Kim, president of Mercy Health Saint Mary’s, will give us updates on the COVID-19 vaccine rollout here in Grand Rapids.

After we hear from Drs. London and Kim, there will be time for audience Q&A, so please come ready with your questions. Register here: https://senatedems.com/brinks/virtual-town-hall-sign-up/.

LEGISLATIVE UPDATE

Property Tax Relief for Homeowners, Businesses

Recently, I introduced legislation to waive penalties and interest for certain property and business owners who didn’t pay their summer 2020 property taxes due to financial and economic hardships created by the COVID-19 pandemic.

Senate Bill 112 would direct the Michigan Department of Treasury to create a form that taxpayers can use to claim a waiver of penalty and interest from their local unit of government. Once summer property taxes are paid in full by the deadline, the local taxing unit would then verify the eligibility of applicants, after which the state would reimburse local governments for the waived penalties and interest.

Businesses eligible for the waiver would include bars, restaurants, and other food service establishments; entertainment venues such as theaters and sports stadiums; and, exercise facilities and recreation facilities like bowling alleys and skating rinks. For homeowners, the penalty and fee waiver request must be for their principal residence.

SB 112 was referred to the Senate Committee on Appropriations.

Bill to Repeal Feminine Hygiene Tax

This week, Sen. Mallory McMorrow (D-Royal Oak) and I introduced Senate Bills 153 and 154 to repeal Michigan’s tax on feminine hygiene products.

This legislation must be a priority. The tax is a hardship for those who are already having difficulty making ends meet, and it’s something only those who menstruate are forced to pay. There should be no room for such inequity.

It is estimated that, over the course of a lifetime, an individual could use about 17,000 tampons and sanitary napkins. These products are a necessity, and the federal government agrees: Last year, through the CARES Act, Congress confirmed feminine hygiene products are qualified medical expenses for payment or reimbursement with an HSA, FSA, or HRA.

So far, 20 states exempt menstrual hygiene products from sales tax, including Alaska, California, Connecticut, Delaware, Florida, Illinois, Maryland, Massachusetts, Minnesota, Montana, New Hampshire, Nevada, New Jersey, New York, Ohio, Oregon, Pennsylvania, Rhode Island, Utah, and Washington. Canada has also eliminated what was commonly referred to as the “tampon tax.”

Gov. Gretchen Whitmer also agrees with this priority. In her Fiscal Year 2022 budget recommendation, she included a provision ending the Michigan sales and use tax on menstrual products and protecting the School Aid Fund from any potential revenue loss.

MDNR: BRAVING WINTER TO ENJOY MICHIGAN’S OUTDOORS

We’re in the thick of winter, and with that comes some of our favorite outdoor activities! Why not join a loved one and try snowshoeing or cross-country skiing? There’s always birding, or getting outside for a peaceful winter hike. Check out winter activities and more on the DNR Winter Fun page. You could also celebrate the DNR’s 100th birthday with their 100 Things to Do list.

Whatever you do, make sure your gear is warm and you’re following COVID-19 safety guidelines. For example, if you’re hanging out with someone who lives outside of your household, stay at least 6 feet apart. You might also want to keep a face mask handy for times when social distancing isn’t possible. Bonus: this can help keep the cold at bay!

TREASURY: INDIVIDUAL INCOME TAX FILING SEASON OFFICIALLY BEGINS

Michigan’s individual income tax filing season officially began this week. Michiganders can start filing their 2020 tax year state individual income tax returns online or by mailing paper forms and supporting paperwork through the U.S. Postal Service. All individual income tax returns must be e-filed or postmarked by Thursday, April 15, 2021.

Also: Many Michiganders received unemployment benefits in 2020 — some for the first time — and it is worth noting that this compensation is indeed subject to federal and state taxes. If taxpayers have received an incorrect 1099-G for unemployment benefits they did not receive, they should report possible identify theft to the Unemployment Insurance Agency (UIA). The UIA will issue a corrected 1099-G once the identity theft is confirmed. Taxpayers who are unable to obtain a timely, corrected form should still file an accurate tax return, reporting only the income they received.

When you do file your taxes, electronic filing and direct deposit is highly recommended where possible. It is convenient, safe, and secure. Last year, more than 4.4 million Michigan taxpayers e-filed, which is 86% of state income tax filers. For more information about e-filing, go to mifastfile.org. Printed tax forms are being distributed and will be available in limited quantities by mid-February at public libraries, some northern Michigan post offices, Michigan Department of Health and Human Services county offices, and Michigan Department of Treasury field offices.

Individuals with low incomes, disabilities, or who are 60 years of age or older may qualify for free tax preparation help from IRS-certified volunteers. For information about free tax help, go to irs.treasury.gov/freetaxprep/ or dial 2-1-1. To learn more about Michigan’s individual income tax or to download forms, go to michigan.gov/incometax.

UPCOMING VIRTUAL COFFEE HOUR

I hope you can join me for a Virtual Coffee Hour TOMORROW, Friday, Feb. 19, between 1 and 2 p.m., on Zoom. This is a great opportunity to discuss important issues in our district from the comfort and safety of your own home.

To register, please email my office at SenWBrinks@senate.michigan.gov and be sure to put “Virtual Coffee Hour” in the subject line. We will send you the link to the meeting before the start of the event.

I look forward to chatting with you and hope to see you online!

CONTACT US

I have other questions. Are you and your office still available?

To keep you and my staff healthy and safe, we are working remotely until further notice. Please call our office at (517) 373-1801 or send me an email at SenWBrinks@senate.michigan.gov, as you normally would, and we will do our best to avoid any interruption of service.

I am still working diligently and engaging with folks in our community, but all in-person events have been canceled for the time being. You can follow me on Facebook or check my website at SenatorBrinks.com for more information on any future events.

Helpful Links