June 23, 2021

Note from Erika

Dear Friends and Neighbors:

Summer is officially here! Sunday the 20th marked the Summer Solstice, as well as Father’s Day. I hope everyone enjoyed the Longest Day and were able to celebrate the fathers, grandfathers, and father-figures in their lives.

Please be aware that while we are re-engaging in-person office operations, we also continue to serve Michigan’s 6th Senate District remotely. If you have any questions or concerns, we can be reached by email at SenEGeiss@senate.michigan.gov and by voicemail at (517) 373-7800.

Erika Geiss

State Senator

6th District

In this Edition

- Update on Voter Suppression bills

- Juneteenth Celebration

- Expanded Child Tax Credit for Families

- COVID Restrictions Update

- Unemployment Assistance

- Community Update

Update on Voter Suppression Bills

On Wednesday, June 16, despite the protests of my Democratic colleagues and me, Michigan Senate Republicans pushed through Senate Bills 285, 303, and 304. These bills are part of the 39 bill voter suppression package and will disenfranchise Michigan voters, make it more difficult to cast their ballots, and gum up the works for local clerks and election workers

Watch my no-vote explanation on SB 285:

Juneteenth Celebration

On Saturday, June 19 (as has been done every year for 156 years), we celebrated the anniversary of the abolition of slavery in the United States. It took two-and-a-half years following the Jan. 1, 1863 Emancipation Proclamation for the news to be shared in Galveston, Texas to announce the freedom from bondage on June 19, 1865.

Not only did we celebrate the emancipation of enslaved people, we also celebrated Juneteenth’s first recognition as a federal holiday across the country President Biden signed it into law on June 17th.

Expanded Child Tax Credit for Families

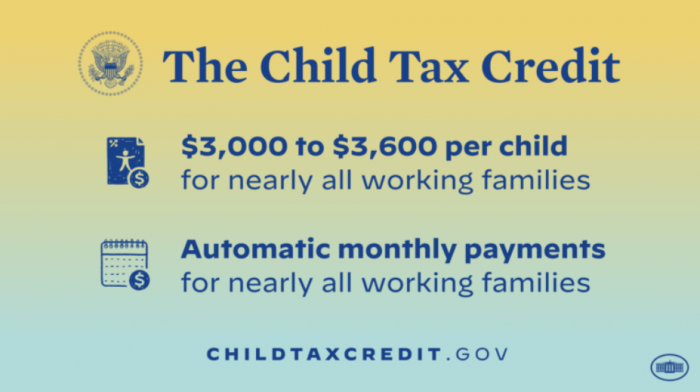

As part of The American Rescue Plan Act of 2021 signed into law March 11, families with children are eligible for the expanded child tax credit amount that was increased for the 2021 filing year.

A family can now receive up to $3,600 per year for children under 6 years old and $3,000 per year for children 6-17 years old. This is an increase from the previous $2,000 per year per child and now includes children 17 years of age. If you filed your tax return for 2019, 2020, or signed up for the Economic Impact Payments using the IRS’s Non-filer Sign-up Tool, you do not have to take any additional action.

The tax credit will be issued as a monthly payment and will not count as additional income that could affect a family’s eligibility for public assistance.

Families meeting the guidelines will receive an Internal Revenue Service-issued check or direct deposit on July 15, August 13, September 15, October 15, November 15, and December 15. The new maximum credit is available to taxpayers with a modified Adjusted Gross Income (AGI) of:

- $75,000 or less for singles

- $112,500 or less for a single parent, also called (head of household)

- $150,000 or less for married couples filing a joint return and qualified widows and widowers

Low-income families with children are eligible for this crucial tax relief – including those who have not made enough money to be required to file taxes. If a couple makes under $24,800, a head of household makes under $18,650, or a single filer makes under $12,400, and they have not filed their taxes, the Non-filer Sign-up Tool can be used to sign up for the federal Child Tax Credit.

Recent estimates from Columbia University’s Center on Poverty & Social Policy find that this expanded Child Tax Credit will reduce child poverty by 45% overall, by 52% among Black children, by 62% among Native American children, and effectively eliminate the most extreme forms of child poverty in America.

Find more information at ChildTaxCredit.gov.

COVID Restrictions Lifted as of June 22

As of June 22, indoor and outdoor capacity increases to 100%. Residents are no longer required to wear a face mask.

Nearly 5 million Michiganders ages 16 and older have received their first vaccine dose, according to Centers for Disease Control and Prevention data. And, according to data from the Michigan Care Improvement Registry, half of Michigan residents have completed their vaccination and more than 60% have received their first shots.

Case rates, percent positivity and hospitalizations have all plummeted over the past several weeks. Currently, Michigan is experiencing 24.3 cases per million and has recorded a 1.9% positivity rate over the last seven days.

Residents who are able to be vaccinated are urged to get any one of the safe and effective COVID-19 vaccines. To learn more about the COVID-19 vaccine and where to find the nearest vaccination site, visit Michigan.gov/COVIDvaccine and VaccineFinder.org.

Please be aware that while occupancy limits and mask mandates are no longer set by the state, businesses still reserve the right to limit seating and require masks in their establishments.

Unemployment Assistance

If you or someone you know who lives in Senate District 6 is having trouble receiving their Unemployment Insurance (UI) or Pandemic Unemployment Assistance (PUA), please fill out this unemployment assistance form and our office will reach out to assist you with your issue as soon as possible.

You can also visit the Michigan Secretary of State FAQ page for answers to questions you may have regarding eligibility for unemployment or for issues you may have with your current claim.

Community Update

Check out this article about two Downriver school districts looking to promote teaching careers for students in their schools.

Additionally, the city of Taylor will be receiving a $387,150 grant from the Michigan Department of Environment, Great Lakes, and Energy; this grant, called a Drinking Water Asset Management (DWAM) Grant, was established under the MI Clean Water Program to assist communities around the state in making improvements to their drinking and wastewater infrastructure

Hollingsworth Logistics LLC has just been awarded a grant from the Michigan Strategic Fund for $1.5 million. With these funds, Hollingsworth will be expanding their operations into Brownstown. They project that this expansion will create roughly 250 jobs. Currently, minority or immigrant residents make up 75% of Hollingsworth’s workforce and we are excited for this opportunity to grow good jobs in our community. Keep on the lookout to apply with this growing firm.