|

Note from Erika After receiving approval from the U.S. Department of Labor, the Michigan Unemployment Insurance Agency announced it is pausing new wage garnishments and state tax refund intercepts for Michigan claimants who were overpaid benefits. For more information, please read our section on unemployment assistance. If you have any questions or concerns, please reach out to our office by email at SenEGeiss@senate.michigan.gov or by phone at (517) 373-7800.

|

|

Erika Geiss State Senator

In This Edition:

LEGISLATIVE UPDATE A Resolution to Recognize Black Maternal Health Week On April 12th, I introduced a resolution to recognize April 11th through 17th as the 5th Annual Black Maternal Health Week and the movement to improve the state of Black maternal health. Founded and led by the Black Mamas Matter Alliance, #BMHW22 is an exciting week of activism, awareness, and community-building. I spoke to the importance and need for Senate Resolution 123 on the Senate floor and you can watch my speech here:

|

|

WAYNE COUNTY FORECLOSURE MORATORIUM EXTENSION Wayne County Treasurer Eric Sabree announced the Treasurer’s office will not foreclose any owner-occupied properties that owe delinquent taxes for tax years 2017 through 2019 if the owner enters an arrangement prior to March 31, 2023. This comes as many taxpayers have not filed applications for available statewide relief programs and need more time and help to do so. >> Read more information about the announcement. If you are delinquent on your property taxes, Wayne County has several programs available that may be able to lighten the financial burden by helping establish payment plans for delinquent taxes. We encourage affected residents to work with the state and Wayne County Treasurer sooner rather than later.

REMINDER: FILE TAX RETURNS, MAKE PAYMENTS BY APRIL 18, 2022 The Michigan Department of Treasury is reminding taxpayers that state individual income tax returns must be submitted electronically or sent through the U.S. Postal Service before midnight on Monday, April 18. Choosing electronic filing and direct deposit is convenient, safe and secure. Last year, more than 4.8 million Michigan taxpayers e-filed, which is 88% of state income tax filers. For more information about e-filing, go to mifastfile.org. Individuals who e-file typically receive their refunds approximately two weeks after receiving c Individual taxpayers who need additional time to file a return beyond the April 18 deadline can request an extension to Oct. 18, 2022. Taxpayers requesting additional time to file should estimate their tax liability and pay any taxes owed by April 18, 2022, to avoid additional interest and penalties. Questions? Taxpayers with questions about their state income taxes are encouraged to use Treasury eServices. The online platform enables taxpayers to ask state income tax-related questions when convenient and avoids the extended wait times for calls this time of year.

UNEMPLOYMENT ASSISTANCE UPDATE The Unemployment Insurance Agency (UIA) announced they are pausing wage garnishments for overpayment collections until May 7th. This comes after securing approval from the U.S. Department of Labor for eligibility waivers for Michigan workers who received Pandemic Unemployment Assistance (PUA) benefits. The UIA will be able to grant waivers to a broad set of workers who meet one or more of these criteria overpayments:

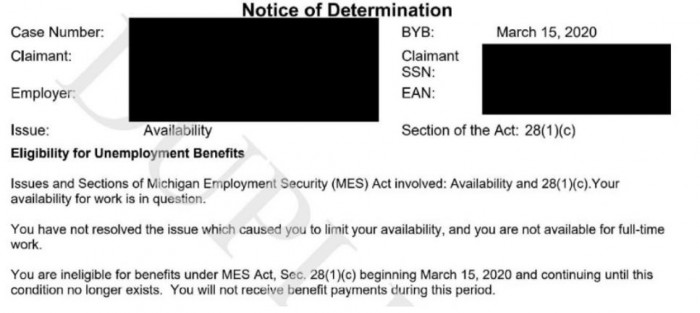

>> Read the full press release here. As well, Senate Bill 445, signed into law by Gov. Gretchen Whitmer, now removes the “able and available” requirement for federal unemployment claims filed during the pandemic. Part-time workers who could not work full-time will not have to pay back the benefits they received and/or may be eligible to claim benefits they were denied. To know if your claim was affected by the previous “able and available” requirement, your Notice of Determination, or Notice of Redetermination will list the “Issue” as either “Ability” or “Availability.” It will look similar to the one below:

|

|

If your claim was denied, you had your benefits halted, or your eligibility was re-determined because of the “able and available” requirement, please fill out the issue form on our website and our office will assist you. As always, if you or someone you know who lives in Senate District 6 is having trouble receiving their Unemployment Insurance or PUA, please fill out this unemployment assistance form and our office will reach out to assist you with your issue as soon as possible. You can also visit the Michigan LEO FAQs page for answers to questions you may have regarding eligibility for unemployment or for issues you may have with your current claim.

COVID-19 VACCINATION UPDATE The U.S. Centers for Disease Control and Prevention announced a second Pfizer-BioNTech and Moderna booster dose is authorized if you meet the following criteria:

If you have not already received your primary dose of the COVID-19 vaccine or booster, now is the time to do so. Information on vaccines, vaccine boosters, and testing locations are available on the Wayne County website. With both the U.S. Centers for Disease Control and the Michigan Department of Health and Human Services revising guidelines for masking, getting vaccinated and boosted now is more critical than ever to help protect ourselves and our communities — especially for those among us who are immunocompromised or otherwise cannot take the vaccine. Beginning at age 5, children are eligible to receive the vaccine. The Wayne County Health Department has established three locations where you can get your child vaccinated. Parents and guardians should consult with their pediatrician or health care providers with questions and concerns as these medical professionals will be the best people to offer the best guidance to your child(ren) and family. *The Wayne County Health Department handles the 42 Wayne County communities outside of Detroit, which has its own separate health department.

COMMUNITY UPDATE March is Reading Month may be over, but the fun of reading is extending into April! This month, Taylor Community Library is hosting a Spring Reading Challenge running from April 1-30. You do not have to be a resident of Taylor to participate. Click here to learn more about how to join!

|

|

As an elected representative, I believe in being readily available and transparent because my office is your office. Email is a great way to share updates, and hear from you on the issues you care about. If you want to alter your email preferences, click here to unsubscribe. |