I hope this newsletter reaches you and your family safe and healthy. It’s an exciting time here in Lansing with budget negotiations ramping up as we work to further investments in our communities, infrastructure, and schools.

Featured in this newsletter:

- Appropriations Update

- In the Community

- Upcoming Coffee Hours

- Resources

As always, if you need anything, please do not hesitate to reach our office at https://senatedems.com/klinefelt/contact/ or by phone at (517) 373-7670.

Veronica KlinefeltState SenatorDistrict 11

Appropriations Update

It is a pleasure to serve as Chair of the Subcommittee on Transportation this session. My recommendation closely mirrors the Governor’s, with a few key additions, noted below:

- Investment in local roads, above what is allocated through Act 51

- Critical rail separation

- High-speed rail

- Critical infrastructure projects

- Intermodal capital investment grants

- Bridge bundling

This budget has been reported out of the Subcommittee, full Appropriations Committee, and the Senate. It now moves on to the House and then to Conference.

You can follow along with the Appropriations process by following us on social media or visiting legislature.mi.gov.

In the Community

|

On April 26 our Constituent Relations Director Christopher Ford had the pleasure of joining the Detroit Lions and Blue Cross Blue Shield Michigan at Dort Elementary School in Roseville for the “Leaders for Life” assembly. He was proud to take part in this event that teaches children important qualities to become a successful leader. |

On April 21st Senator Klinefelt and our Constituent Relations Director Christopher Ford visited Henry Ford Macomb Hospital. They toured the facilities, including the new North Tower, and spoke with CEO Barbara Rossmann about the importance of investing in healthcare.

Upcoming Coffee Hours

Thank you to everyone who came to our May 8th coffee hour in Roseville! If you haven’t made it out yet, we hope to see you at an upcoming coffee hour.

WHEN: Friday, May 26, 2023, at 10 amWHERE: Heilmann Recreation Center, 19601 Brock Ave, Detroit, MI 48205WHEN: Monday, June 5, 2023, at 10 amWHERE: Recreational Authority of Roseville & Eastpointe, 18185 Sycamore St, Roseville, MI 48066WHEN: Friday, June 16, 2023, at 10:30 amWHERE: Fraser Public Library, 16330 14 Mile Rd, Fraser, MI 48026WHEN: Monday, July 17, 2023, at 12:30 pmWHERE: Peace Manor, 17275 Fifteen Mile Rd, Clinton Twp, MI 48035

Resources

MRCC Career/Job Fair Opportunities

The Michigan Regional Council of Carpenters and Millwrights are offering an exciting career opportunity for people with or without construction experience. At this event, you will have the opportunity to connect with Union Carpenters and Millwrights to learn about potential new careers and job opportunities. Safety attire including hardhats, boots, gloves, safety glasses and jeans are required, and will be available for anyone who does not have them.

WHEN: Saturday, May 20, 2023, at 8 amWHERE: Union Carpenters and Millwrights Skilled Training Center, 11687 American Ave, Detroit, MI 48204

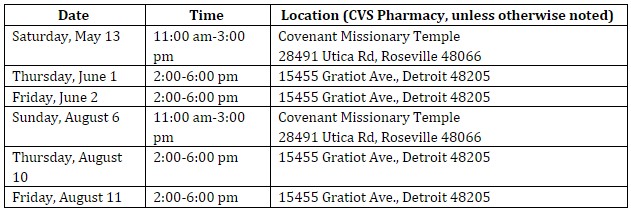

You can RSVP for this career event here.Project Health – CVS

No-cost, no-catch health checkups. Select stores, most Thursdays–Sundays.

From blood pressure readings to mental health assessments, they are here to support your whole health.

Learn more about offerings at CVS.com/ProjectHealth

Resources if you missed the Tax Filing DeadlineTaxpayers can be United with Outstanding Refunds, Avoid Interest and Penalties

Michigan taxpayers who missed the April 18 state individual income tax filing deadline last week have options for filing a late return, according to the Michigan Department of Treasury (Treasury).

Treasury recommends past-due tax filers to consider:

- Filing a return to claim an outstanding refund. Taxpayers risk losing their state income tax refund if they don’t file a return within four years from the due date of the original return. Go to www.michigan.gov/mifastfile to learn more about e-filing.

- Filing a return to avoid interest and penalties. File past due returns and pay now to limit interest charges and late payment penalties. Failure to pay could affect a taxpayer’s credit score and the ability to obtain loans.

- Paying as much tax as possible. If taxpayers owe outstanding taxes and can’t pay in full, they should pay as much as they can when they file their tax returns. Payments can be made using Michigan’s e-Payments service. When mailing checks, carefully follow tax form instructions. Treasury will work with taxpayers who cannot pay the full amount of tax they owe.

Taxpayers who receive a final tax bill and are unable to pay the entire amount owed can consider:

- Requesting a penalty waiver. Penalty may be waived on an assessment if a taxpayer can show reasonable cause for their failure to pay on time. Reasonable cause includes serious illness, a fire or natural disaster, or criminal acts against you. Documentation should be submitted to substantiate the reason for a penalty waiver request.

- Making monthly payments through an installment agreement. For Installment Agreements lasting for 48 months or less, taxpayers must complete, sign and return the Installment Agreement (Form 990). The agreement requires a proposed payment amount that will be reviewed for approval by Treasury.

- Filing an Offer in Compromise application. An Offer in Compromise is a request by a taxpayer for the Michigan Department of Treasury to compromise an assessed tax liability for less than the full amount. For more information or an application, visit www.michigan.gov/oic.

The last three options for final tax bills should be filed separately from the state income tax return.

Questions?

Michigan taxpayers who have questions about or need help with their individual income tax returns or refunds can digitally connect with the state Treasury Department through its Treasury eServices platform.

To learn more about Michigan’s individual income tax or to download forms, go to www.michigan.gov/incometax.AARP Ask the Doc Series

Introducing AARP Michigan’s first-ever interactive virtual health series taking place every Tuesday in June from 12-12:45 p.m. Listen in as health and medical professionals share practical advice and answer questions on specific health issues that so many of us endure.

- DreamZzz: Reclaim the NightTuesday, June 6 | 12-12:45 pmDiscover the secrets to a revitalizing night’s sleep with the first session in our Ask the Doc series. Gain practical tips so you can say goodbye to sleep deprivation and realize the benefits of a good night’s sleep to overall well-being and brain health. Join us to reclaim the night!Register here or call (877) 926-8300.

- Pain Points: Ease the AcheTuesday, June 13 | 12-12:45 pmDon’t let joint pain limit your mobility. Join us for Session II of our Ask the Doc series for practical strategies to reduce joint pain and improve joint health, including exercise, nutrition and lifestyle modifications. Regain your mobility and improve your quality of life!Register here or call 877-926-8300.

- What You Need to Know About Gut HealthTuesday, June 20 | 12-12:45 p.m.Did you know a healthy gut is crucial for overall well-being? Join us for Session III of our Ask the Doc series as we explore gut health. We’ll discuss common issues and practical strategies addressing conditions like leaky gut, food intolerances and microbiome imbalances.Register here or call 877-926-8300.

- Gotta Go Right Now!Tuesday, June 27 | 12-12:45 pmTune in for Session IV of the Ask the Doc series on urinary incontinence and accompanying pelvic and low back pain. Gain valuable insight into the causes, symptoms and treatment options along with practical tips to improve your quality of life. Join us and take control of your health!Register here or call 877-926-8300.