McDonald Rivet-led expansion of the Michigan Earned Income Tax Credit for Working Families takes effect Feb. 13, saving households $3,150 through average combined federal and state EITC

LANSING, Mich. (Jan. 26, 2024) — On EITC Awareness Day today, Sen. Kristen McDonald Rivet (D-Bay City) encourages Michiganders to help spread the word and take advantage of the most significant increase to the credit in state history. It’s the first tax season when Michigan’s match of the federal Earned Income Tax Credit will reach 30%.

“These dollars are a tremendous help to workers who are on the tightest of budgets. When families have financial stability, it improves so many other parts of their lives,” said Sen. McDonald Rivet, long-time champion and lead sponsor of the EITC increase. “We made this tax relief retroactive to tax year 2022, so households who qualified last year will automatically receive checks for the increased difference. That will help with awareness, and we’re going to put as much energy into helping eligible families claim this credit for tax year 2023 as we did expanding the state’s match to 30 percent.”

Why is EITC Awareness Day important? One-third of the EITC population changes each year. The IRS estimates only four out of five qualifying workers claim the EITC. This leaves billions of dollars on the table. In Senate District 35, approximately two out of five eligible households fail to claim this credit. Even if workers don’t owe any tax, filing to get this credit could result in a substantial refund, providing stability for low- and moderate-income families. According to the IRS, 664,000 Michigan workers claimed $1.7 billion through the EITC last year.

“The EITC provides greater opportunity for solid footing for so many in our community. Understanding that families mainly spend these funds locally on basics like groceries, childcare, utilities and housing, it really is a win-win for them and our local economy,” shared Beth Sorenson Prince, Director of Impact at United Way of Midland County. “Many workers don’t take advantage of this credit because they don’t know about it. The newly increased state match of 30% will make an incredible impact, so we’re glad to have Sen. McDonald Rivet’s help in raising awareness to positively impact every eligible family.”

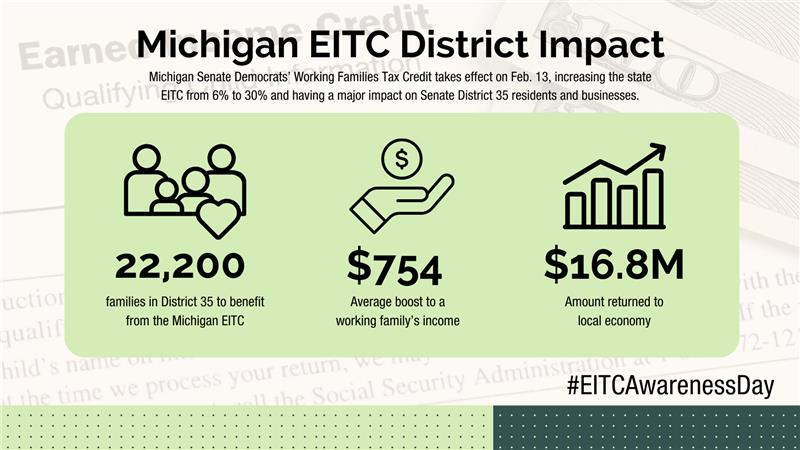

About 22,200 families in Senate District 35 stand to receive an additional $600 thanks to the credit’s expansion, based on the most up to date Michigan League for Public Policy analysis of Michigan Department of Treasury data. In addition to benefiting individual households, the new Working Families Tax Credit will boost the Great Lakes Bay Region— contributing an estimated additional $16.8 million to its local economies and small businesses.

The Michigan Earned Income Tax Credit for Working Families is part of Senate Democrats’ biggest tax relief delivered to Michiganders in decades. Along with the Retirement Tax Repeal, the expanded state match of the EITC will contribute a billion dollars annually to Michigan’s local economies and provides a needed financial boost to over 700,000 working families and 500,000 retirees. Both measures take effect Feb. 13, 2024.

Anyone who received the original 6% state match in tax year 2022 will automatically get a supplemental check mailed to them for the retroactive increase. Those checks, averaging $600 across the 35th Senate District, will begin to mail February 13, 2024. Families should file as usual to claim the credit for tax year 2023. Among other requirements to claim the EITC, you must have worked and earned income under $63,398. Michiganders can verify their eligibility by visiting IRS.gov/EITC. The Michigan Department of Treasury encourages residents to stay up to date with information at Michigan.gov/taxes.

If Michigan residents meet EITC income requirements, they can qualify for free tax help. Residents can call 1-800-906-9887 or visit IRS.gov/vita to find IRS-trained volunteers for free tax return preparation. Eligible Michigan residents across the state can also call 2-1-1 on any phone or visit MichiganFreeTaxHelp.org to connect with a free tax preparation expert who can help them claim all the tax credits available, at no cost, ever.

Last year, nearly 230 organizations signed a letter urging Michigan leaders to adopt a 30% match of the federal EITC, citing it as a “pro-work” policy with immediate impact to boost local purchasing power. Locally, this included business groups like the Bay Area Chamber of Commerce, Midland Business Alliance and Saginaw County Chamber of Commerce, the Midland Area Community Foundation, and the United Way of Midland County and other community and human services organizations around the state.

The federal EITC was created by Republican former President Gerald R. Ford and a Democratic Congress. The Michigan EITC was established by a Republican-led Legislature in 2006 and signed into law by then-Gov. Jennifer Granholm, a Democrat. Over the years, the EITC has been touted by Republicans and Democrats alike, including former President Ronald Reagan, Republican former U.S. House Speaker Paul Ryan, and Democratic former presidents Jimmy Carter and Barack Obama.

###