WHAT IT IS

- It reduces the tax you owe, putting more money in your pocket!

- Even if you do not owe tax, it could result in a refund!

- This extra income can help you care for your family, meet living expenses, or save for the future.

HOW IT BENEFITS YOU

- Democrats expanded the Michigan EITC from 6% of the federal

EITC to 30%. - This saves families in our district an additional $603 on average.

- The average combined Michigan and federal tax credits will return $3,150 to eligible tax filers.

WHAT’S NEW?

- Democrats expanded the Michigan EITC from 6% of the federal

EITC to 30%. - This saves families in our district an additional $603 on average.

- The average combined Michigan and federal tax credits will return $3,150 to eligible tax filers

* Estimate of families and average savings is based on 2019 data from the

Michigan League for Public Policy.

1 in 5 eligible households miss out on the EITC. Don‘t let that be you!

To claim the Michigan EITC, you must qualify for the federal EITC. Basic qualifying rules for the federal EITC require that you must:

- Have worked and earned income under $63,398

- Have investment income below $11,000 in tax year 2023

- Have a valid Social Security Number (SSN) by the due date of your 2023 return (including extensions) and everyone you claim on your taxes must have a valid SSN

- Be a U.S. citizen or a resident alien all year

- Not file Form 2555, Foreign Earned Income

- Meet certain rules if you are separated from your spouse and not filing a joint tax return

Note: There are special qualifying rules for military, clergy, and taxpayers as well as their relatives with disabilities

Verify if you are eligible for the Michigan EITC by visiting Michigan.gov/taxes/iit/eitc.

Hardworking families should be able to afford the basics. To help working families struggling the most with housing, food, childcare, and other expenses, Democrats quintupled Michigan’s match of the federal Earned Income Tax Credit (EITC) from 6% to 30% — putting an annual average of $3,150 back in the pockets of 700,000 Michiganders.

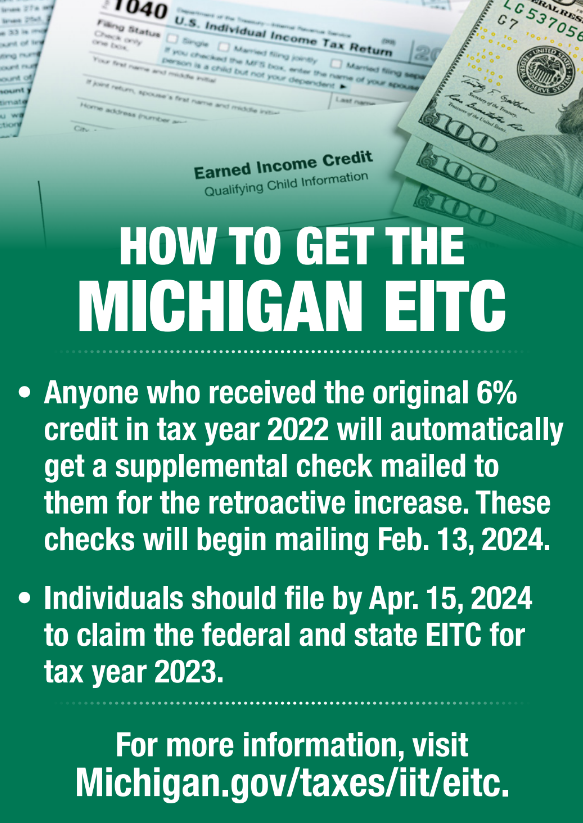

We made this tax relief retroactive to tax year 2022, so households who qualified last year will automatically receive checks for the increased difference. Those checks, averaging $600 in our district, will begin to mail February 13, 2024.

Dollars from the combined state and federal EITC will make a big difference, and I want to help every eligible family claim their 2023 tax year benefits. Visit IRS.gov/EITC or Michigan.gov/taxes/iit/eitc to see if you qualify, and reach out to my office if we can assist you with the Michigan Treasury or any other state agency.

Sincerely,

Kristen McDonald Rivet

State Senator

District 35