Michigan Democrats’ Working Families Tax Credit taking effect on Feb. 13 quintuples state EITC, will save 22,200 local families in Senate District 28 an average of $600 more

LANSING, Mich. (Jan. 26, 2024) — On EITC Awareness Day today, Sen. Sam Singh (D-East Lansing) celebrates the passage of the most significant increase to the credit in state history. To help alleviate financial hardship for families, Sen. Singh voted in support of the Working Families Tax Credit legislation — quintupling Michigan’s match of the federal Earned Income Tax Credit (EITC) from 6% to 30%.

“I encourage all eligible residents of District 28 to take advantage of the Michigan EITC this year. From awareness to expansion, we’re continuing the fight to make sure the EITC can make a difference for even more Michigan workers and families,” said Sen. Singh. “With the boost to the credit taking effect next month, this credit will not only offer hardworking families an even greater and much-needed financial lift this tax season, but also play a crucial role in bolstering local economies. These savings will directly fuel investments in the small businesses that are the backbone of our local communities.”

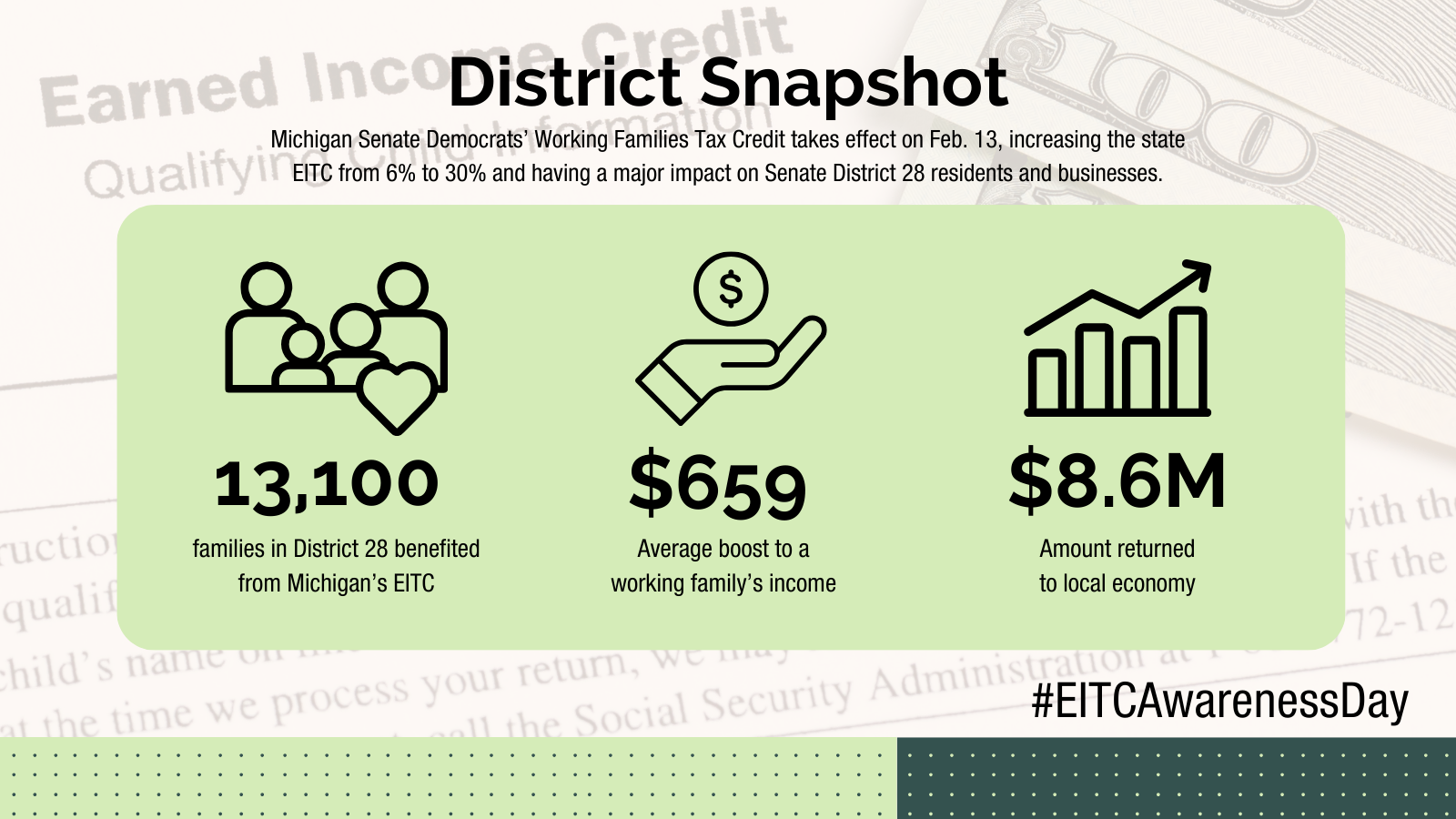

Based on the most up-to-date Michigan League for Public Policy analysis of Michigan Department of Treasury data, about 13,000 families in Senate District 28 stand to receive around $500 more thanks to the credit’s expansion. The boost to the Working Families Tax Credit will help the region as well as individual households, as it is estimated that the increased credit will contribute around $8.6 million to local economies and small businesses. The EITC is often spent on necessities like child care, car repairs, new appliances, groceries and more. Increasing the state EITC is a two-generation policy that helps kids by helping their parents, and it has been proven to have myriad positive benefits on kids.

The increased credit takes effect on February 13, 2024, and Michiganders can verify their eligibility by visiting IRS.gov/EITC. In addition to claiming it this tax season, the expanded Michigan EITC is also retroactive to the 2022 tax year (last tax season). Federally eligible individuals who claimed the Michigan EITC on their 2022 taxes received the original 6% credit. After the expansion takes effect, the Michigan Department of Treasury will begin to issue supplemental check payments over a period of 5-6 weeks to provide eligible taxpayers with the remaining 24% portion of the credit. The Michigan Department of Treasury encourages residents to stay up to date and verify their eligibility at Michigan.gov/taxes.

Last year, nearly 230 organizations signed a letter urging Michigan leaders to adopt a 30% match of the federal EITC, citing it as a “pro-work” policy with immediate impact to boost local purchasing power. Locally, this included business groups like the Lansing Regional Chamber of Commerce, the Old Town Commercial Association and other community and human services organizations around the state.

If Michigan residents meet EITC income requirements, they can qualify for free tax help. Residents can call 1-800-906-9887 or visit IRS.gov/vita to find IRS-trained volunteers for free tax return preparation. Eligible Michigan residents across the state can also call 2-1-1 on any phone or visit MichiganFreeTaxHelp.org to connect with a free tax preparation expert who can help them claim all the tax credits available, at no cost, ever.

The federal EITC was created by Republican former President Gerald R. Ford and a Democratic Congress. The Michigan EITC was established by a Republican-led Legislature in 2006 and signed into law by then-Gov. Jennifer Granholm, a Democrat. Over the years, the EITC has been touted by Republicans and Democrats alike, including former President Ronald Reagan, Republican former U.S. House Speaker Paul Ryan, and Democratic former presidents Jimmy Carter and Barack Obama.

###