Dear Neighbor,

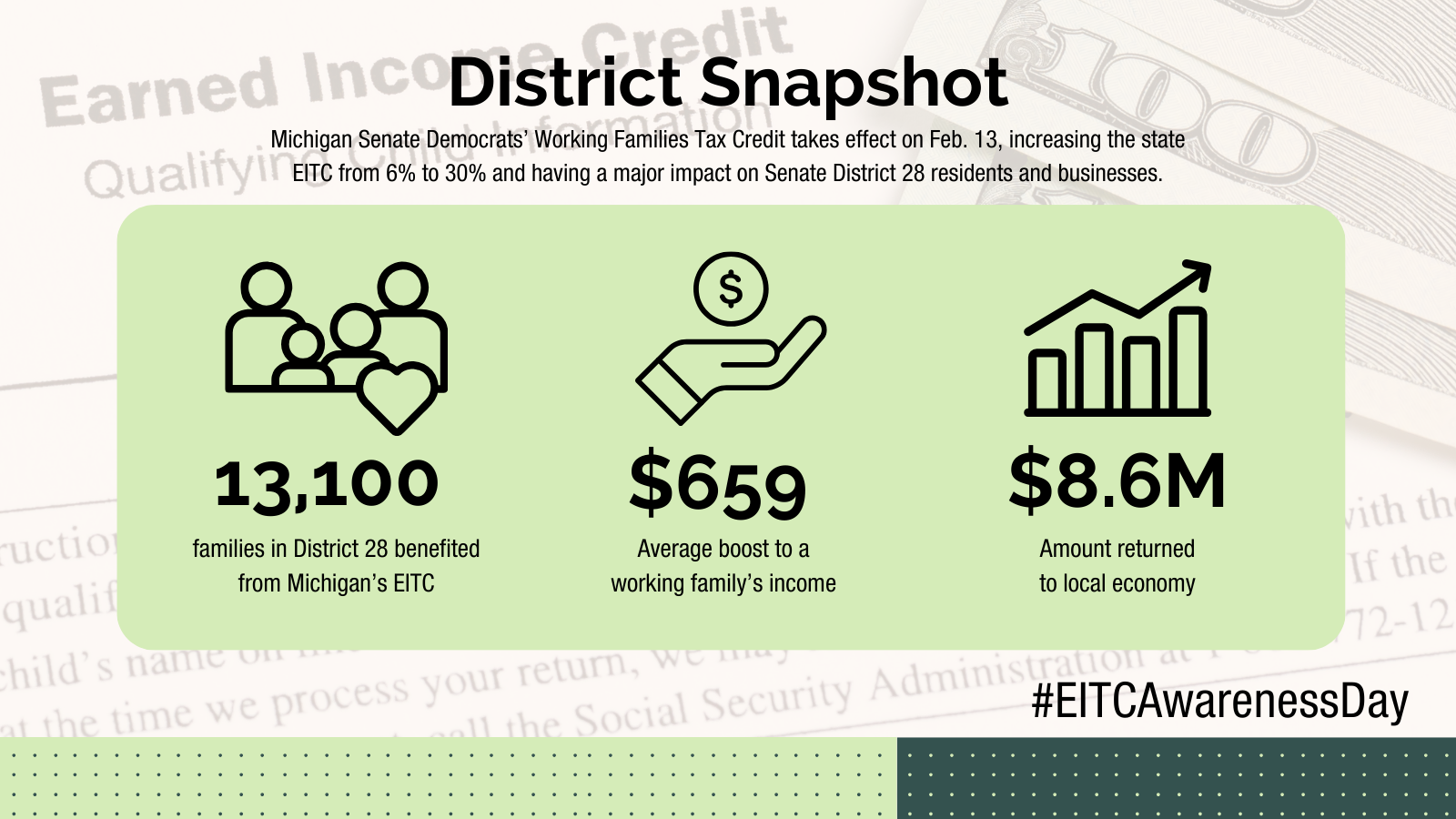

Today, Friday, January 26, is Earned Income Tax Credit (EITC) Awareness Day. Every year on EITC Awareness Day, community organizations, elected officials and various stakeholders come together in a nationwide effort to boost awareness of refundable credits, targeting potentially eligible taxpayers during the tax filing season — ensuring millions of deserving workers claim the credits they’ve earned. You can see the direct impact that the EITC has had for families in our community in the snapshot below.

Last year, nearly 230 organizations, including United Way, signed a letterurging Michigan to adopt a 30 percent match of the federal EITC. The state EITC legislation to adopt the federal standards will take effect on February 13. For free tax preparation assistance, click here.

I hope you’re able to take advantage of the EITC this year. While we are not tax professionals, if you have questions or need assistance, you can email my office at SenSSingh@senate.michigan.gov or call (517) 373-3447, and we will assist you the best we can or get you in contact with someone who can.

Sincerely,

Sen. Sam Singh

State Senator

District 28